Saturday, December 26, 2009

Xmas in Detroit!

While wild bears have been spotted in SE Michigan, I believe Crowder is mistaken about bears being spotted within the city limits of Detroit. Otherwise this video rocks.

edit:

Not sure the embedded player is working. The original url is http://www.youtube.com/watch?v=1hhJ_49leBw

Wednesday, December 23, 2009

Anyone surprised?

What the article does not point out is that these researchers are also government employees.

Tuesday, December 22, 2009

Pod-cast on intellectual property.

Wednesday, December 16, 2009

Detroit unemployment

Wednesday, December 9, 2009

Next Meeting - Thursday 12/17/09

5:30 to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

Discussing chapter 8 & 9 of Henry Hazlitt's Economics in One Lesson, the questions on the corresponding study guide, Modern Day Protectionism by Vedad Krehic, and Jack Spirko's Survival Podcast #327

Once again I picked the podcast unheard, but I have since given it a cursory listening. I have never listened to one of his "listener questions" show and am pleasantly surprised by this one. Spirko does a good job of making himself look reasonable and not a conspiracy theorist nutjob. None of the topics are discussed in great depth. That doesn't seem to be a drawback other than the 401k question which leaves some things unanswered in my mind. The podcast and topics discussed are below. Spirko's "housekeeping" runs long this episode, so you can skip the first 7 minutes before getting into the actual questions & answers.

- What is better a well and private septic or city water and sewer or both

- What do I think of Bob Chapman’s latest predictions

- Will the government ever try to go after 401K earnings by changing the rules

- Is buying land today buying “stolen land”

- Thoughts on using paint cans for food storage

- What to plant on remote land

- Are the prices at coinflation the “spot price”

- Setting a gun argument between a husband and wife, is there a cut and dry answer

Sunday, December 6, 2009

Another side effect of government intervention

In response, they are increasing and introducing other fees, including an account inactivity fee.

Everyone who voted for the Act failed at learning Economics in One Lesson: "The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy..."

I wonder how long it will be before someone proposes a new bill to prevent credit card companies from charging these fees.

Tuesday, December 1, 2009

Mainstream media admits that health care bill is robbery

"Affordable insurance key for young adults" - Medill News Service via Detroit Free Press

WASHINGTON -- The young invincibles. That's what the insurance industry calls the 13.7 million Americans younger than 30 who don't have health insurance because, they firmly believe, they just don't need it.

In the debate over health care, lawmakers and the health care industry agree that persuading this demographic to jump into the insurance pool is important because they're healthy and don't need costly medical care. Their premiums would help subsidize older, less healthy people, thereby bringing down average costs. That's one of the reasons why the health care bills circulating in Congress would require most Americans to get health insurance.

But for young adults to make the leap, experts said, Congress needs to focus more on affordability.

Young adults are more likely than people in other age groups to work low-wage, entry-level jobs that don't offer health insurance, according to the Kaiser Family Foundation. As a result, Americans 19 to 29 have the highest uninsured rate in the United States.

This contradiction is sickening.

Paragraph 1: Healthy people generally don't need health insurance.

Paragraph 2: Therefore, they should pay for the unhealthy people.

Paragraph 3: But don't rob the healthy people TOO much-- just steal an "affordable" amount.

Tuesday, November 24, 2009

Next Meeting - Thursday 12/03/09

Thursday December 03, 2009Discussing chapter 6, 7, & 8 of Henry Hazlitt's Economics in One Lesson, the questions on the corresponding study guide, and a Scott Horton's interview TBD. If time permits, maybe we'll discuss Vedad Krehic's "Modern Day Protectionism" and NewEdit's response.

5:30 to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

Friday, November 20, 2009

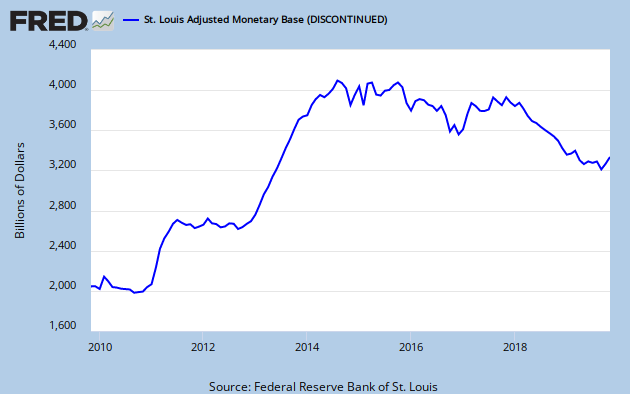

Adjusted Monetary Base

Yesterday RM noted that the monetary base is on a skyward trajectory once again, as the chart above shows (http://sn.im/tcd4t). The official reason being to boost the economy. RM's question was if all they have to do is print money to boost the economy, why was TARP needed a year ago. We agreed that it is all smoke & mirrors. This does not look good for the economy.

Another Prediction

Thursday, November 12, 2009

Next Meeting: Thursday November 19, 2009

Thursday November 19, 2009Discussing chapters 4 & 5 of Henry Hazlitt's Economics in One Lesson and the questions on the corresponding study guide as well as Scott Horton's interview of Tim Wise.

5:30 to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

http://antiwar.com/radio/2009/10/23/tim-wise/

Scott Horton Interviews Tim Wise

October 23, 2009Tim Wise, director of the movie Soldiers of Peace, discusses the worldwide outbreak of peace (really!), reconciliation of Christians and Muslims in Nigeria, ending the vicious cycle of tribal retribution, ranking the benevolence of nations with a Global Peace Index and how free trade and open communication decrease the likelihood of war.

MP3 here. (30:05)

Tim Wise is the director of the documentary movie Soldiers of Peace. Tim has freelanced for all the major news networks around the world focusing on ‘Hard Access’ news stories. From his base in London, where he lived for 10 years, Tim worked on a wide range of assignments for such networks as BBC TV, CH4 News, SABC South Africa, EOTV Holland, NHK Hong Kong, ABC Australia ‘Foreign Correspondent’ & ‘Four Corners”, WTN London, DRTV Denmark, Focus Germany, RTL and ZDF Germany.

During this time, Tim traveled to some of the most dangerous countries in the world including Iraq, Bosnia, Northern Sri-Lanka, East Timor, Liberia, Colombia, Southern Sudan, Burma and East India. He also did a series of filming stints working undercover from China, Kurdistan, Burma and Sri-Lanka.

In 2003 Tim was involved in the making of the international award-winning documentary ‘Child Soldiers’ for ABC TV Australia where he spent 2 weeks living with one of the child soldier units of the SPLA rebels of Southern Sudan. In Assam in East India Tim gained unprecedented access to the ULFA rebels, the first western journalist to ever do so in the 18 years that ULFA had been in existence. Tim was smuggled into their secret bases inside Bhutan and went out on operations with the rebels as they fought with the Indian Army. He was also smuggled inside Burma with the ABSDF student rebels while making an ABC Four Corners report.

Tim has also freelanced for the Award winning SBS TV show ‘Dateline’ where he reported from Northern Uganda covering the LRA rebels – The Lord’s Resistance Army of Joseph Kony, that has abducted over 30,000 children and forced boys as young as 10 into becoming child soldiers and girls to become porters, cooks and sex slaves for the top LRA commanders.

Tim is now the CEO of the documentary production company One Tree Films, which was established in 2006 with founder Steve Killelea. The core aims is to produce world-class documentaries focusing on social issues. Soldiers of Peace is their first film together.

Tuesday, November 10, 2009

Arguments against arguments against intellectual property

*By copyright I do not mean that a government agency would enforce copyrights. I mean that the artist has a natural right and rule over his IP.

Also, I am not interested in the utilitarian/"practical" argument that copyrights limit creative output, since that assertion is secondary to the moral argument.

1. The author indicates that taking a jacket without paying for it would be theft. However, he says that copying a CD of music is not theft, because the original CD still exists and still belongs to its owner. But this does not make sense to me, because a new copy of the property has been introduced:

Each jacket can only be worn and enjoyed by one person at one time. A jacket owner may sell his copy of the jacket, but then he can no longer wear that copy. Similarly, an individual could rightfully sell his copy of the CD, but then he would no longer be able to enjoy that CD. Now, if two people want the jacket, then the second person has to buy a copy of the jacket and pay its creator. The creator has now been paid to make two copies of the jacket. So if a second person wants to enjoy the CD, then the creator of the CD should get paid for two copies of that CD.

The author says, "If I walk into a store and leave with a jacket for which I have not paid then I have deprived the store's owner of his or her justly acquired, tangible property. They have one less jacket. They are directly harmed by my action."

Likewise, if you copy a CD, the creator has been deprived of one less copy to sell. Someone is getting value from the creator's work without paying the creator. The creator is directly harmed.

1a. Copying art seems to me to be like inflation of the money supply. Only one copy really exists for which the creator has been paid (only one ounce of gold really exists), but we proceed as though all the copies of that value have been accounted for (as though each federal reserve note actually represents something).

The author says, "The original CD is still my friend's property. I return it to him, and while he is no better or worse off than he was before, I am now better off." This sounds exactly like fractional reserve banking: you still have your original dollar, but now I have an extra dollar, too! Well, no, you don't. You've created false "value" out of nothing and proceeded as though no-one is harmed.

2. Those against copyrights often focus on tangible property. They seem to suggest that the value of the CD is in tangible property of the CD itself. But the value is in the sounds of the music. Note that no-one pays a premium for blank CDs or for books that say "alsjksl;jdfasklfjsak." Rather, what they are paying for is the music or the particular arrangement of words and ideas in the book. Many libertarians seem to not acknowledge that property other than physical property is a valid concept.

3. Many libertarians say that it is admissible to make private contracts about not copying art, but that that contract can't extend to a third party. For example, the author says, "It is possible that I could, for example, have made an agreement or contract with [my friend] when I borrowed the disc stating that I cannot copy it. If I were to do it anyway, I'd be in violation of a private agreement."

I see a discrepancy here. Either non-tangible things (music, text) can be property or they cannot. If they can be property, property rights apply. If they cannot be property-- as libertarians often seem to suggest when they focus on the physical plastic CD rather than on the music-- then this concession about private contracts doesn't hold because there would be no real property about which to make a contract. It would be an invalid contract because there would be no real property. So which is it? Either IP is property and is subjected to property rights (as I assert), or IP is not property and therefore you can't make private contracts about something that doesn't exist.

Saturday, November 7, 2009

Thursday November 12, 2009Discussing chapters 1-3 of Henry Hazlitt's Economics in One Lesson and the questions on the corresponding study guide.

5:30 to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

For the current podcast, we'll be discussing Jack Spirko's Survival Podcast #305 - You Can't Lose as a Modern Survivalist and Survival Blog's related article, Preparing for Uncertain Times--A Simple Guide to Getting Ready.

A big reason for picking podcast 305 is that I don't agree with a lot of Spirko's points and I totally disagree with Preparing for Uncertain Times. Maybe someone will be able to change my mind. While I find disagreement with much in podcast 305 and I agree with some of the assessments that Spirko's podcasts aren't very indepth, I think they are worthwhile. He's not a doomsayer claiming the end of the world is at hand and he seems to be implementing a decent version of the Alpha Strategy. Points in the podcast I disagree with include:

- You can't be free if you have any debt

- Credit cards are evil

- Storing food always pays for itself

- Survivalism creates a better life even if you never need to implement any of it

- The bank owns your home if you have a mortgage (and related to this is the etymology of mortgage as "death grip"; the actual etymology is dead pledge)

Episode-305- You Can’t Lose as a Modern Survivalist

The number one question I get from non preparedness minded individuals when I tell them about The Survival Podcast is simply, why?

Why takes many forms such as…

- Why do you worry about so many things you can’t control?

- Why do I need to do anything different then I am doing now, I got this far OK, right?

- Why should I spend money on things I may never need or even use?

- Why should I sacrifice just to be “debt free” because “you’re no one unless you own money in the nation anyway”?

- Why should I store food?

- Why do I need a gun, we have a nice town and a great police force?

- Why do you feel the need to be an alarmist?

Oh and that list of why’s goes on and on, I assure you. Yet I always answer every single why with the same answer, “because the way I do things my life is better even if nothing bad ever happens”.

Tune in today as we discuss this concept and thoughts on how…

- Living debt free is the only way to have the freedom we all desire

- Why most people tolerate things in their life they should never allow

- Why tax is theft and why understanding it creates freedom

- Why no matter what people say you do need to prepare for bad times

- How the media and the government create plastic lifestyles that we choose to live within

- Why storing food will always pay itself back even if you never have to rely on it directly

- Why a garden is liberating and a financial gain

- Why so many people that start to prep fail and fall out and how to change that

Thursday, October 29, 2009

Detroit's socialist nightmare is America's future

http://www.thedailycrux.com/content/3247/Porter_Stansberry

Political Anarchy is the solution for Detroit as well as the nation. Bill Bonner described a good starting point in A Depression – With a Capital ‘D’

Want to save Detroit? Here’s how:

Abolish all welfare of all sorts…no unemployment insurance…no child tax credits…no welfare…no foodstamps…no nothing, except privately-sponsored charities. Close the public schools. Kick out all the bureaucrats and all federal and state employees. Abolish all rules concerning employment – no minimum wages, no overtime, discriminate all you want. Require all residents to say please and thank you…dress properly…and sneer at people who don’t seem to be gainfully employed or polite. Declare the city an Open City and Free Trade Zone. In exchange for cutting all federal aid programs, eliminate federal and state taxes for people living in the city. Allow unlimited immigration into the city…giving all immigrants a U.S. passport after 5 years of residency. Levy a flat 10% tax to pay for basic services. Eliminate elections…have the city controlled by a town council composed of 10 citizens chosen at random.

Within five years, Detroit would be the most dynamic city in the nation.

Wednesday, October 21, 2009

Next Meeting - Thursday 10/20/09

Thursday October 29, 2009

5:30ish to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

Discussing chapter 12 of America's Great Depression and Jack Spirko's Survival Podcast #293 - Economic Forecast.

http://www.thesurvivalpodcast.com/episode-293-economic-forecast-10-08-09

Episode-293- Economic Forecast 10-08-09

So today we are going to discuss my view of what we can expect from the economy in the next few years and what we can do to prepare for it. I will tell you why I think 2010 is actually going to look pretty decent and on the other side why you shouldn’t take that much comfor in it. Then next week we will take a day to compare my view to the view of many of the experts such as Jim Rodgers and Gerald Celente.

Tune in today to hear…

- Why I think we are about to see a fake recovery followed by a bigger crash

- The stimulus doesn’t kick in until 2010, how it will succeed and how it will fail

- Unemployment is “bottoming” the truth and the lies about that statement

- This coming bubble and collapse is planned, I will explain why there is no other option then this one

- Credit cards can’t fix a debt problem and how that relates to our national deficit

- How the impact of Health Care won’t be seen until late 2011 perhaps longer and the disaster it will create

- The coming 1.5 Trillion Dollar tax increase from the administration that promised not to do it

- How high taxes reduce the amount of tax government collects and what it does to the economy

- Why inflation looks like recovery at the beginning

- Why you need to own at least some silver and or gold

- Land is cheap, go make a low ball offer while you can

- Store food, build your own grocery store at home

- Spend smart don’t horde money, balance your assets

- Place priority of spending on assets with long term value

- Keep some cash, don’t believe the lies about putting all cash into gold right now

- Debt is evil, always in good times and bad

- Never be 100% invested in any item or investment type

- Do not liquidate IRAs and 401ks modify their portfolios but leave the money in the vehicles

- Above all never “freak out”, make smart and strategic spending and saving decision you do have time to act, don’t panic and react to swiftly to concerns

Wednesday, October 7, 2009

Next Meeting

Tuesday October 13, 2009

5:30ish to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

Discussing chapter 11 of America's Great Depression and Scott Horton's interview of Rebecca Vilkomerson

Chapter 11: The Hoover New Deal of 1932

http://antiwar.com/radio/2009/09/18/rebecca-vilkomerson/

Scott Horton Interviews Rebecca Vilkomerson

September 18, 2009Rebecca Vilkomerson, National Director of Jewish Voice for Peace, discusses the activist campaign to stop Caterpillar from selling bulldozers to Israel, what interested people can do to help promote peace, how the peace party can learn from the organizational and media saturation successes of the war party and the importance of criticizing anti-Semitism as well as those who misuse the charge (see MuzzleWatch).

MP3 here. (23:24)

Rebecca Vilkomerson is the National Director of Jewish Voice for Peace. She has over fifteen years of experience in community organizing, advocacy, program development and fundraising in the United States and Israel. In the U.S., she focused on economic justice issues, especially regarding women. She has been an active member of JVP since 2002, and lived in Israel with her family from 2006-2009.

Most recently, Rebecca worked for a Palestinian Israel public policy center and a Bedouin-Jewish environmental and social justice organization, as well as continuing her work as an activist for a just peace in Palestine and Israel. Her study, Public Policy in Divided Societies: The Case for a Civil Rights Institution was published in July, 2008 by Dirasat, the Arab Center for Law and Policy. She is also currently an editor of Jewish Peace News. Rebecca is a graduate of Connecticut College and has a Master’s Degree in Public Policy from Johns Hopkins University.

Two Shocking Visuals

The Billion Dollar Gram is a shocking visual of govt waste. The picture seems self explanatory, so I won't comment further.

The second graphic that caught my eye was the third of the Four Infographic Morsels. A small version is below. A larger version can be seen by clicking the image, clicking the blog link above and scroll down, or click http://farm3.static.flickr.com/2595/3941254968_7f70fbd209_b.jpg.

Afghanistan, the graveyard of empires, outnumbered 9 to 1 (16 to 1 if include all private security contractors) is kicking the USG's ass. Unfortunately Obama is too stupid to learn from history.

Friday, September 18, 2009

Next Meeting

Tuesday September 22, 2009

5:30ish to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

Discussing chapter 10 of America's Great Depression and Scott Horton's interview of Daniel Lakemacher and if there's interest, a related interview with Adam Szyper Seibert.

Chapter 10: 1931-"The Tragic Year"

http://antiwar.com/radio/2009/09/16/daniel-lakemacher

Scott Horton Interviews Daniel Lakemacher

September 16, 2009

Daniel Lakemacher, founder of the website WarIsImmoral.com, discusses his conscientious objector (CO) discharge from the U.S. Navy, how the experience of working at Guantanamo and (independently) learning about the libertarian “non-aggression principle” changed his mind about war and justice, the process of becoming a CO and how the military defines morality in terms of obedience/disobedience.

MP3 here. (25:03)

Daniel Lakemacher was discharged as a conscientious objector from the U.S. Navy on 09/11/09. He is the founder of the website WarIsImmoral.com

http://antiwar.com/radio/2009/09/12/adam-szyper-seibert/

Scott Horton Interviews Adam Szyper-Seibert

September 12, 2009

Adam Szyper-Seibert, counselor and office manager at Courage to Resist, discusses Lt. Ehren Watada’s successful resistance to an Iraq deployment, the year-long waiting list for treatment at the VA, the fraternal bonds that keep reenlistment rates high, increased military success (since WWII) in training soldiers to be hate-driven killers and the “Ft. Bragg 50″ who are held without charges in degrading conditions.

MP3 here. (38:01)

Adam Szyper-Seibert is a counselor and office manager at Courage to Resist, an organization that provides support to military resisters.

Wednesday, September 9, 2009

"Solidarity forever"

Here is fantastic video of one of the rallies, complete with song and dance. Check out the "stop administration dictatorship" sign.

Tuesday, September 8, 2009

Stock Charts: 1929 & 2009

The first one, from http://www.online-stock-trading-guide.com/1930-stock-chart.html, shows 4 1/2 years of the DJIA from Oct 1928 to March 1933. That is one year prior to the 29 crash until the bottom of the market in 33. In comparison is a chart of the last 3 years from BigCharts. This is a little more than one year prior to the start of the current depression. This makes the relative starting points of the two charts a little off but fairly close. We haven't transgressed 3 years into the recession, so the current chart is of shorter duration.

The second set of charts compares 1930 (once again from http://www.online-stock-trading-guide.com/1930-stock-chart.html) to 2008. The stock market crash occurred in October 1929, a couple months after the Great Depression began. The current recession supposedly began in December 2007. Thus, 1930 is the first full year of the Great Depression and 2008 is the first full year of the current depression.

The last set of charts compares the period of 1924 to 1933 to the past decade of 1999 to 2009. The 1924 to 1933 chart is duplicated in numerous places on the web, but I pulled it from http://www.gold-eagle.com/editorials_01/seymour062001.html. The circles refer to quotes listed in the article at gold-eagle.com. If you haven't seen the article before, click through for a good read.

If we overlaid the second chart starting in 2003 onto the first chart starting at 1925, it looks like there would be strong similarity.

While trying to find charts, I came across one other interesting comparison. From Numbers From the Wasteland, here is current unemployment to unemployment in the 20s & 30s.

If you have any other good comparisons or better charts, please post.

If you have any other good comparisons or better charts, please post.

Friday, September 4, 2009

Unemployment continued.

He also stated, "The Recovery Act is doing more, faster and more efficiently and more effectively than most people expected" (AP).

July's unemployment numbers are showing how well the stimulus plan is "working".

The percentage of unemployed workers is going up, yet again. July's percentage is 9.7% of the work force is not employed. An overall increase of .3% unemployment between June and July.

Thursday, September 3, 2009

Interview

Monday, August 31, 2009

Retirement Accounts

- they may be taken over by the government by the time I retire

- due to inflation the money could be worth very little by the time I retire

For these reasons I closed out my account (tax penalty and all) when I quit my last job and did other things with that money.

I planned to not start a 403(b) ever again.

However, one of the places I am working is offering a double match. If I contribute 5% of my salary, they contribute an additional 10%. That is a lot of money and it is tempting. However, I resent the fear-mongering ("you need over 2 million dollars to retire") and bad financial advice ("markets always go up") given by the shady sales people that work for these companies.

Right now I am leaning toward opting out, but the 10% is pulling me back in. To be eligible for a double match from the school, I'd have to enroll by the end of September.

With the assurance that I in no way hold you responsible for what I decide, does anyone have any thoughts or advice on this?

Choices offered (I don't fully understand what these mean):

From TIAA-CREF

- Multi-asset - mutual fund

- Equities - variable annuity and mutual fund

- Real estate - variable annuity

- Fixed income - variable annuity and mutual fund

- Money market - variable annuity and mutual fund

- Guaranteed - guaranteed annuity

- NO LOANS

From Fidelity

- "Freedom fund" - mutual fund, seems to have no employee freedom, Fidelity chooses allocations

- "Money market trust"

- Not sure what else; didn't give much information

- NO "SELECT" PORTFOLIOS including gold, energy, etc.

Update: the "select" sector funds ARE being added to Fidelity's options starting in January

Thursday, August 27, 2009

Unemployment Rate.

John Miller wrote in the Dollar and Sense article that the true adjusted rate is 16.4%.

Anthony Mirhaydari's article on MSN money states the unemployment rate to be closer to 20%.

The Detroit Free Press has a strong and viable number for the City of Detroit's percentage to be at 28.9%

Next Meeting

Tuesday September 8, 2009

5:30ish to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

Discussing chapter 9 of America's Great Depression and Scott Horton's interview of Cindy Sheehan. We may include a brief discussion of chapter 8 due to some confusion regarding assigned chapters at the last meeting.

Chapter 8 - The Depression Begins: President Hoover Takes Command

Chapter 9 - 1930

Today Scott Horton interviewed Cindy Sheehan. I haven't heard anything from Cindy in a couple years and had no idea that Camp Casey had been set up in Martha's Vineyard during Obama's vacation. The description seems to indicate that Sheehan, a leftist, is criticizing other leftists for their complete lack of integrity. Sounded interesting, so I have chosen it for the AWR interview for the next meeting.

http://antiwar.com/radio/2009/08/27/cindy-sheehan

Scott Horton Interviews Cindy Sheehan

Scott Horton, August 27, 2009

Peace activist Cindy Sheehan discusses how to keep the antiwar movement alive during a Democratic presidency, the activist groups willing to trade integrity for Washington access, the universal right to life and liberty and Camp Casey’s move to Martha’s Vineyard during Obama’s vacation there.

MP3 here. (17:31)

Cindy Sheehan became a leader of the antiwar movement after her son, Casey, was killed in Iraq. Her efforts to get answers from President Bush, including a vigil in Crawford,Texas, have received national media attention. She has a website, is the author of Peace Mom: A Mother’s Journey through Heartache to Activism and wrote the introduction to 10 Excellent Reasons Not to Join the Military.

Thursday, August 20, 2009

Anitwar Radio Interview for 8/25/09 Discussion

http://antiwar.com/radio/2009/08/18/thomas-e-woods-2/

Scott Horton Interviews Thomas E. Woods

August 18, 2009

Thomas E. Woods, author of Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse, discusses the debt some progressive causes owe to states’ rights, vintage 1812 war propaganda that sounds alarmingly like the run-up to the war in Iraq, state nullification of unconstitutional federal laws and the undue respect given to the Supremacy Clause.

MP3 here. (36:05)

Thomas E. Woods, Jr., is the New York Times bestselling author of nine books. A senior fellow at the Ludwig von Mises Institute, Woods holds a bachelor’s degree in history from Harvard and his master’s, M.Phil., and Ph.D. from Columbia University.

Saturday, August 15, 2009

S&P Index vs. the M1 Money Supply

Next Meeting

Tuesday August 25, 2009

5:30ish to 8:00 pm

Panera Bread

28551 Schoolcraft Road

Livonia, Michigan

Discussing chapters 7 & 8 of America's Great Depression and an AWR interview TBD.

Chapter 7 - Prelude to Depression: Mr. Hoover and Laissez-Faire

Chapter 8 - The Depression Begins: President Hoover Takes Command

Speaking of Predictions

| NewEd | Dave | EH | Xorp | MC | RM | ||||||

| Gold | 750 | > 1000 | 1350 | 1125 | 850 | 700 | |||||

| Oil | 60 | > 60 | 60 | 60 | |||||||

| DJIA | 8100 | <7000 | > 9800 | 4000 | |||||||

| S&P | 800 | <700 | 744 | > 1060 | 1300 | 400 | |||||

| Nasdaq | - | <1200 | |||||||||

| Inflation | 4 | 9 | |||||||||

| Unempl | 11 | 10 | 10 | 10 |

| 12/31/08 | Alltime High | ||

| Gold | 856.40 | 1023.50 | |

| GLD eft | 86.52 | 100.44 | |

| SLV eft | 11.20 | 20.621 | |

| Oil | 44.60 | 147.27 | |

| DJIA | 8776.39 | 14279.96 | |

| S&P | 930.25 | 1576.09 | |

| Nasdaq | 1577.03 | 5132.52 | |

| Inflation | 3.8 | ||

| Unempl | 7.2 |

New Edit

Gold - year end of $750, after having reached a high of $1100 in the summer

Oil - will fluctuate around $60

DJIA - year end 8100

S&P - year end 800

Nasdaq - don't follow enough to even attempt to guess

Inflation - will be reported at 4%, but this will be based on a new formula for calculating it

Unemployment - 11% (may also be subject to new counting methods)

The economy will continue to get worse but Obama will still be heralded as a great guy. He will say that "we are all in this together" and that part of the Hope And Change involves sacrificing for the good of the country.

Dave

My predictions are what the items will hit during the year, not necessarily the year end price. I think I may be too conservative. Gold may go over $1100 or $1200 but I don't think it will get much higher. DJIA may drop below 6000 but I don't think it will drop below 5000 and the S&P may drop below 600 but not 500. The Nasdaq is more volitile, so it could drop the most, but not under 800.

I'm not sure if Obama will get reelected. The republicans will put up a loser to run against him which will give him a good chance. But unlike Mark & Ken, I don't think he'll have high approval ratings. I believe all the "hope" of the Obama supporters will be dashed against the rocks. High unemployment & high inflation will cause a situation like Carter's and people will not be happy with him. If the republicans can somehow come up with a dynamic candidate, Obama will lose.

E.H.

For 2009 I'll predict $1350 for gold and a 20% decline in the S&P.

Xorp

I'll make a similar call as in the mid 90's and early 00's, though different asset class. Only the names and the asset class changes :-)

1) Clinton reelected coincident with economic inflationary boom (dot-com)

2) Bush II re-elected during period of inflationary boom (housing boom)

Since this new phase of monetary expansion (see the M1) coincides with a first term administration in DC, all other things being equal, I think the Obama administration will be hailed as economic geniuses towards the end of 2012, and will remain in power. Starting your first term coincident with the beginning of a new Central Bank inflationary/boom is like being dealt a royal flush. See Clinton/Bush calls above.

In 2000 it was the dot-com bubble, in 2006 it was the housing bubble, in 2012'ish I think it will be the alternative energy bubble. The derivatives market that will un-wind will be the "carbon credit" market. No matter what bubble popped, or pops next, all are technically credit induced by the central bank, only the underlying asset class changes with each new bubble (dot-com, housing, alt-energy).

The next bubble starts now, in alternative energy. Dot-com and housing are dead, never to be heard from again. How crazy is that?

Mark

Very interesting Ken,

I think you are on to something. My predictions tend to be more on the moneyed elites manipulating the price of gold much to the char grin of the Austrians. The fix is in. The powers that be won't make the Austrian case easy. We will be right in the end, but Rome fell for over 500 years. The new Rome has several rallies left.

gold- 850

S&P - 1300

On the geo-political side

Obama is definitely re-elected. We will get our first major spill over of the Israeli/Palestinian conflict in the US (someone will bring the fight across the ocean). Several years down the road...massive amounts of malinvestment will leave us with sparkling roads but no one can afford a car or gas.

I've been having a tough time predicting what will happen next. It's like playing monopoly and then a random guy (Federal Reserve) comes out of no where and knocks the game board off the table. Even better, it's like Charlie Brown trying to kick the football and Lucy pulls it away at the last minute. Charlie thinks (Federal Reserve encourages him in this direction) he figures out the problem so he buys new cleats. Sadly Charlie still doesn't kick the ball and now he has new shoes with no value....

Alt energy is definitely the bubble. I will attempt to ride it up and down.

S&P 999

Thursday, July 16, 2009

The Big Picture by Bob Murphy

-Mark

http://www.lewrockwell.com/murphy/murphy160.html

Tuesday, July 14, 2009

Schiff for Senate

I'm writing to ask you to support Peter Schiff's senate race (he was Ron Paul's economic adviser in the 08 presidential campaign). Today he announced that he will run if he can raise enough money to win (approx $20 million). Every little bit helps, my first donation was today for $25.

Please check out his video on youtube http://www.youtube.com/watch?v=nlnkuskRwYI

4:48 seconds into the video he talks about his possible run.

P.S. Peter has promised to refund the money if he decides there is not enough interest and doesn't run.

http://www.schiffforsenate.com/

P.S. I apologize for "spamming up" an anarchy = no leader = no senate blog with this post but I sincerely believe that a Peter Schiff run can enlighten the open mind and help the remnant find more people, much like the Ron Paul campaign did for me.

Below is the email that was sent to me earlier today.

A Message from Peter Schiff

Dear Mark,

I just wanted to let you know that I am now able to take online donations on my website http://schiffforsenate.us1.list-manage.com/track/click?u=45b009ba848bc9d8a6cd9bda5&id=e2eb643946&e=2c440ac975.

My decision to run is largely dependent on the level of early support and contributions I receive from people like you. I have commissioned polling that shows this to be a winnable race and I am ready to make the personal and financial sacrifice to run, but now it's up to the people to show their support because no candidate can win this race alone. Over the next several weeks we will be taking contributions at my website http://schiffforsenate.us1.list-manage.com/track/click?u=45b009ba848bc9d8a6cd9bda5&id=eb96892918&e=2c440ac975, and weighing the public support for my candidacy. If the support is there, I will answer the call. However, if the public sentiment for my run is not there, I will return the contributions.

Free-market conservatives have an opportunity in 2010. With your help and support, I believe this will be our generation's chance to make a difference for ourselves and our children. Join me. Show your support for free market principles by making a contribution on my website http://schiffforsenate.us1.list-manage.com/track/click?u=45b009ba848bc9d8a6cd9bda5&id=20f8d13f9a&e=2c440ac975.

It's time we made ourselves heard.

Best regards,

Peter

Tuesday, July 7, 2009

"Fifty things to do NOW if you fear an economic breakdown"

http://fau.anarplex.net/?p=26

Linked to from LRC

Friday, June 26, 2009

AGD Chapter 3 questions

- GENERAL OVERPRODUCTION, paragraph 2, "If [businessmen] wish to sell their 'surplus' stock, they need only cut their prices low enough to sell all of their product."

Does this mean that people will buy things they don't really want if the price is low enough? If so, is that really true?

- DEARTH OF "INVESTMENT OPPORTUNITIES," paragraph 3, "If total consumption increases due to population growth (and there is no particular reason why it should)..."

How could it not? Does each person not have a baseline requirement for consumption, so each additional person would mean an increase in total consumption by at least that baseline?

- DEARTH OF "INVESTMENT OPPORTUNITIES," paragraph 4, "Austrian theory teaches us that investment is always less than the maximum amount that could possibly exploit existing technology."

Don't understand what this means. Example?

- DEARTH OF "INVESTMENT OPPORTUNITIES," paragraph 6, "In a free market, prices determine costs and not vice versa, so that reduced final prices will also lower the prices of productive factors-- thereby lowering the costs of production."

This is counter to what I've understood up until now. Example?

Regarding the next meeting - I think I'm free all Tuesdays in July.

Wednesday, June 17, 2009

Bank of America and credit cards

a) complain about Bank of America

b) ask about alternative credit cards.

I am no fan of Bank of America and never have been (even before the bailouts). Last fall BoA took over LaSalle Bank, where my accounts were held at the time, so I closed my accounts and transferred them to a small county bank. ¾ of a year later BoA still sends me statements showing $0 balance, even though I’ve called numerous times to verify that the accounts are closed, not just inactive. Their disorganization and inefficiency is absurd.

BoA also acquired whatever company was previously in charge of my credit card. I rarely use a credit card and immediately pay any balance I do have, so at least BoA is not making money off me (except perhaps by selling my name). Unfortunately, my most recent statement contained two foreign transactions—one for $100.00 Mexican pesos and one for $500.00 Mexican pesos. This comes to less than $50 USD but it is still incorrect. Trying to sort this out is quite a frustrating process. First, the BoA credit card phone tree is worse than most phone trees. Having worked one summer in customer disservice I consider myself decent at manipulating the computers into letting me speak directly with a person. With BoA, I was directed through multiple layers of the phone tree, with the final branch asking the exact question as the first branch. Then I was on hold for 30 minutes, which was bad enough without a southern-accented female voice intoning how much BoA appreciated my business. The “account executive” (minimum wage cubicle worker) who finally answered was most unhelpful at explaining why there were so many long pauses after I answered his questions. Good CSR people are supposed to be quick, and if they are not, they are supposed to describe what they are doing. For example: “Now I am slowly typing your first name. Now I am taking a break to watch YouTube. Now I am slowly typing your last name and misspelling it, even though it already appears on my screen because you input all of your data in the phone tree.”

Anyway, during the course of filing the dispute, the CSR asked me several times if I was sure I hadn’t stayed at a hotel in Mexico. I realize that many people try to pull scams and that the company must therefore exercise caution in accepting fraud reports, but there is also an inconsistency: I personally know a person who plead guilty to a felony involving stealing a BoA credit card, committing identity theft, and making > $20,000 worth of fraudulent charges on the card. BoA is not pursuing the matter because it’s not worth their expenses to try to obtain payment from her. On the other hand, BoA treats a person who truly did not make < $50 of fraudulent charges like a scam artist. And anyway, the CSR said five minutes later, “Oh, it looks like a telecommunications company” (not a hotel).

The CSR also had flawed logic… or should I say the script from which he was reading was flawed. He indicated I should not be worried about identity theft because the charges only occurred on one day, and because a subsequent charge (something I had in fact purchased) was accurate. ?

Anyway, once this is resolved I’d like to cancel the card entirely. As part of homesteading and self-sufficiency it is becoming even more important to me to deal as locally as possible, and to avoid contributing to and participating in a monstrous “system” that is inefficient and unworkable. In the future I suspect there will be a point when I stop participating in this mess at all. For now, I would like to have a small, as-basic-as-possible credit card for the following purposes:

- I sell sheet music; the majority of people want to pay through PayPal; PayPal requires a credit card

- Credit cards serve as a source of identification and things like car rental companies require credit card reservations, even if your final method of payment is different

- They are a type of insurance in case one is traveling and needs to pay for car repairs or emergencies and is not carrying cash.

Therefore I am seeking a card that has a small limit ($500 would be fine), and is NOT OWNED BY A MAJOR BANK. “Perks” such as airline miles, points, and anything even as mildly complicated as cash advances and balance transfers are undesirable. Supposedly independent cards turn out to have payment centers operated by BoA, Chase, etc. If any of you know of or ideally have experience with small, independent credit card companies, please let me know. Thank you.

Monday, June 1, 2009

How to talk to “normal” people?

Lately I’ve been having more trouble than usual talking to average, everyday people, because nearly every topic is contaminated by invalid terms and ideas associated with government. I can only stare blankly at people in genuine confusion because the more I realize the inherent nature of government the less I can comprehend any standards it sets. This inability to communicate is probably not a good thing, especially if we hope to expose others to better ideas. Do any of you know what I mean? If yes, how do you work around this?

Here is an example.

Today at work I read the Food Institute Report, a weekly industry newsletter to which the company I work for subscribes. It reported that

I do not understand that seemingly simple sentence because I don’t understand what a “consumer” is and why they need special protection. I don’t understand how this bill increases “informed choice” because nutrition data is already available on websites, brochures, etc. Subway even puts calorie values on its napkins.

Then

How can we begin to show the inaccuracy of this statement, since doing so would require accepting the governor’s (State’s?) implication that a “better” choice is a lower calorie choice, which is hardly the case? But assuming we accepted that false notion and wanted to factually disprove his statement, perhaps we could reference data showing that, since the introduction of food labeling on product packages, obesity rates have continued to rise. For example, in 1994, when The National Labeling and Education Act of 1990 (NLEA) required product nutrition labeling, the CDC reported that 10-14% of adults were obese in 23 states, and 15-19% of adults were obese in the remaining 27 states. By 2007 only one state had obesity rates below 20%, 19 states had obesity rates ranging from 20-24%, 27 states had obesity at 25-29%, and three states had obesity rates greater than 30%.

- We’d have to concede that “consumers” looked at the product labels.

- We’d have to use data from the CDC, a government agency.

- We’d have to accept that eating high calorie foods is itself enough to cause obesity.

- We’d have to accept the government cut-off values for obesity.

- We’d have to accept the government measure of obesity, which is the Body Mass Index, a totally inaccurate assessment of health developed by a Belgian mathematician-astronomer in 1832.! (Ironically, the CDC’s own website admits that BMI is flawed—and admits its own incompetence. After listing some superior methods of measuring body fat it says, “However, these methods are not always readily available, and they are either expensive or need highly trained personnel.” Nice acknowledgement that highly skilled people tend not to work for the government ;-)

Using the CDC data to argue against

Richard Daines, the State Health Commissioner, “applauded the Governor’s efforts.” He said, “This legislation … demonstrates Governor Paterson’s dedication to addressing the obesity epidemic and will improve the health and lives of all New Yorkers.”

What does it mean to be “dedicated to addressing” something? How will shoving data in people’s faces and contributing to information overload improve their health and lives?

Senator Thomas Duane said, “New Yorkers can save millions of dollars in health care costs through this simple program and I will fight for its enactment.” Whose money is he talking about? Private insurance? Taxpayer-funded programs like Medicare? What is this “health care cost?” Would health care cost matter to him if private insurance companies were paying for it, rather than fascist state-affiliated programs whose lobbyists were pressuring him? Where is the connection between mandated menu data and improved health? Why does he think that a person who is overfat doesn’t know, in 2009, that French fries contain more calories than an equivalent mass of carrots? Why does he think that a person going to a fast-food drive-through would actually choose a different item when told that a given item has 2,000 calories? Why does he think anyone cares about this?

As you can see, I am genuinely confused and my thoughts are all in a jumble due to government making a complexity out of something that is really quite simple: customers are going to eat what they like and food services should have the freedom to offer those choices.

So when a newspaper article or a co-worker or a random person on the street says something like, “I think that bill is a good idea because it will help people be healthy,” I have no appropriate response.

When presented with similar comments, do you attempt to address them by conceding government standards in your argument? Do you attempt a lengthy explanation? Do you not bother? …

Wednesday, May 20, 2009

Saturday, May 16, 2009

Let the market be your guide

I'm writing this entry from the bed. The wife and I are sitting in our wonderful market creation, a tempurpedic adjustable bed, goes from bed to "couch" at the press of a button.

My wife is reading a book "Better: A surgeon's notes on performance." In it there is a passage about the number of soldiers in Iraq that were being blinded. So the govt. in all its infinite wisdom gave out a contract for special safety sunglasses (probably a no bid contract). Guess what happened??? Eye injuries did not go down. The soldiers thought the glasses were ugly and didn't wear them. "They look like something a Florida senior citizen would wear." The author continues, " So the military bowed to fashion and switched to cooler-looking Wiley-brand ballistic eyewear. The rate of eye injuries decreased markedly."

How many ex-soldiers are now blind because the market was not allowed to work. If there was a normal bidding process that involved the soldiers, the "cool" glasses would have won out. Soldier after soldier would have said, "I ain't wearing them ugly things." and hopefully the powers that be would have made the correct decision.

Another example of the state not being in touch with reality or the market....

There have been many stories of planes, trucks, and other motor vehicles crashing due to operator fatigue. The following are excerpts from an article on cnn.com http://www.cnn.com/2009/TRAVEL/05/15/pilot.fatigue.buffalo.crash/index.html

"Her body basically said, 'I can't handle it,' " speculated Greg Feith, former NTSB air safety inspector. "I mean, we've all been there before and pulled an all-nighter. We know how that feels."

Shaw did not "reserve adequate time to travel from her home to her base in order to ensure she was properly rested and fit for duty."

With fatigue being a possible factor in the crash, the testimony at this week's NTSB hearings is reigniting industry concerns over pilot fatigue. Airline accidents caused by fatigue are listed on the "Most Wanted Transportation Safety Improvements" on the NTSB Web site.

The article then goes on to say that "While there is no way to tell if the pilot is rested when one steps onto a plane, there are Federal Aviation Administration guidelines on how many hours a pilot can work and how many hours he or she must rest."

That is simply not true. Are they even looking for a solution? Wouldn't it be in their best interest to actively search for and even fund start up companies that are working to solve this problem?

I am currently invested in a company that is working on and is close to a solution. http://www.ecnholding.com/product.php (have your audio on)

Disclaimer: It's a sub penny stock at the moment and I'm down 80%. Yes, it's the same sub penny stock that the folks in the RPIC told me to sell about a year ago... Sane people sometimes make insane investment choices...

Here is a company that is very close to solving a major problem, but govt. officials are still saying that there is no way to tell if the pilot is rested.

The sad thing is that I will probably have a fatigue detection device in my car before the FAA even knows it exists.

I guess the only thing a passenger on a airplane can do is talk to the pilot when they get on the plane and make their own decision regarding his/her vigilance.